The first step in stock trading is to open a stock account. Over the past week, mixed signals from official statements and media reports have left traders increasingly puzzled about when the Bank of Japan will raise interest rates. This situation is reminiscent of the lead-up to Japan’s stock market ‘Black Monday’ in August, when there was no certainty about whether the Bank of Japan would raise rates at the end of July meeting, and the eventual decision to do so triggered a storm of unwinding yen carry trades.

At the beginning of his tenure, Bank of Japan Governor Haruhiko Kuroda was widely praised for his clear and orderly communication style, which was seen as a significant difference from his predecessor, Shinzo Abe, who often shocked the global market with unexpected decisions. However, even with this, the current Bank of Japan decision-making body has faced criticism, especially after the July rate hike led to a historic plunge in the Japanese stock market and global market turmoil. Recently, the Bank of Japan’s communication style has given traders a sense of déjà vu from this summer…

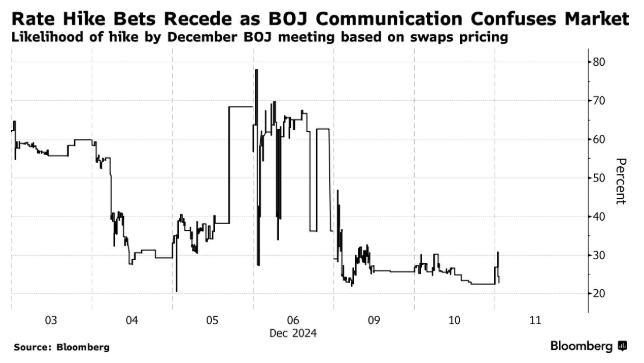

A serious divergence has emerged between media surveys and interest rate market pricing – slightly over half of the economists surveyed by Reuters last month expected the Bank of Japan to raise interest rates in December. However, the current overnight index swap pricing indicates that the possibility of a rate hike in December is only about 22%. (Note: A similar situation occurred with the July rate hike, where media surveys predicted no rate hike, while the interest rate market pricing predicted a hike) Ryutaro Kimura, a fixed income strategist at AXA Investment Managers in Tokyo, stated, “Focusing too much on the speech date to make decisions now seems very dangerous. If the Bank of Japan believes it can raise rates in January next year, there is actually no reason why it shouldn’t do so in December.” The unknown is the most dangerous. Although central banks are not obligated to inform traders exactly what they are going to do, there is no doubt that the more surprises they create, the greater the likelihood of abnormal market fluctuations, which could also disrupt long-term investments in the economic field. From a timing perspective, the Bank of Japan’s interest rate decision next week will be made just a few hours after the Federal Reserve’s decision, which is widely expected to lower rates at its next meeting. The divergence in interest rate direction between the two central banks could again lead to significant volatility in Japan’s stock, bond, and currency markets. A rate hike by the Bank of Japan would naturally push up the yen. If it decides to stand pat, the yen is likely to depreciate rapidly at first – of course, if the market quickly incorporates the possibility of a rate hike in January into the price, the yen’s decline may be limited. Regardless of whether the Bank of Japan raises rates or not, Governor Haruhiko Kuroda may provide new guidance on future interest rate paths and triggers for action at the post-meeting press conference, which will also become a major focus for the market. Some industry insiders predict that if the Bank of Japan keeps rates unchanged this month, Kuroda may send hawkish hints to avoid triggering an unwanted yen crash and explain the key factors he will study carefully in judging the timing of a rate hike. On the other hand, if the Bank of Japan decides to raise rates this month, Kuroda may send more dovish signals, convincing the market that the Bank of Japan will not automatically continue to raise rates but will proceed with the next tightening measures more cautiously. In addition to the interest rate decision, the Bank of Japan will also release next week its analysis of the pros and cons of various unconventional monetary easing tools used in the 25-year battle against deflation, marking another symbolic step towards ending large-scale stimulus policies.

The conclusion of the review is likely to be that, compared to unconventional measures such as the large-scale asset purchase program by the former Bank of Japan Governor Haruhiko Kuroda, interest rate cuts remain a better tool to address economic stagnation. SMBC Nikko Securities’ Senior Interest Rate Strategist, Ataru Okumura, wrote in a report that complex communications are likely to continue until the eve of the Bank of Japan’s December meeting. If the Bank of Japan has not made a clear decision by then, the argument for a rate hike in December may once again take the lead. Experience the new and innovative investment research assistant immediately. (Source: Caixin Global)